Credit scores can be a confusing and uncomfortable subject even for the financially savvy. It’s true that your score plays a major role in your ability to get approved for a mortgage loan. It also can impact your interest rate, the amount you need for a down payment and the type of loan program you are eligible for.

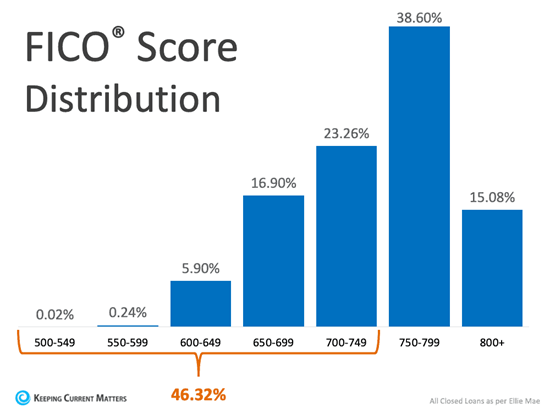

According to data from the Origination Insight Report by Ellie Mae, the average FICO® score on closed loans reached 753 in February. As lending standards have tightened recently, many are concerned over whether or not their credit score is strong enough to qualify for a mortgage. While stricter lending standards could be a challenge for some, many buyers may be surprised by the options that are still available for borrowers with lower credit scores.

The fact that the average American has seen their credit score go up in recent years is a great sign of financial health. As someone’s score rises, they’re building toward a stronger financial future. As more Americans with strong credit enter the housing market, we see a natural increase in the FICO® score distribution of closed loans, as shown in the graph below: