¿Está Pensando En Vender Su Casa Tal Como Está? Lea Esto Primero

ISi está pensando en vender su casa este año, probablemente esté considerando dos opciones:

- Venderla tal como está y evitar cualquier reparación.

- Realizar algunas mejoras para que luzca mejor y, potencialmente, se venda a un precio más alto.

En 2026, esta decisión será más importante que antes. Le explicamos por qué.

Más Viviendas En Venta: El Estado De La Propiedad Vuelve A Ser Clave

El inventario de viviendas ha aumentado y, según las previsiones de Realtor.com, el número de casas en venta podría incrementarse un 8,9% este año. Con más opciones disponibles, los compradores pueden permitirse ser más selectivos, lo que significa que los detalles y el estado de la propiedad vuelven a ser importantes.

Esa Es Una De Las Razones Por Las Que La Mayoría De Los Vendedores No Optan Por Vender La Propiedad Tal Como Está.

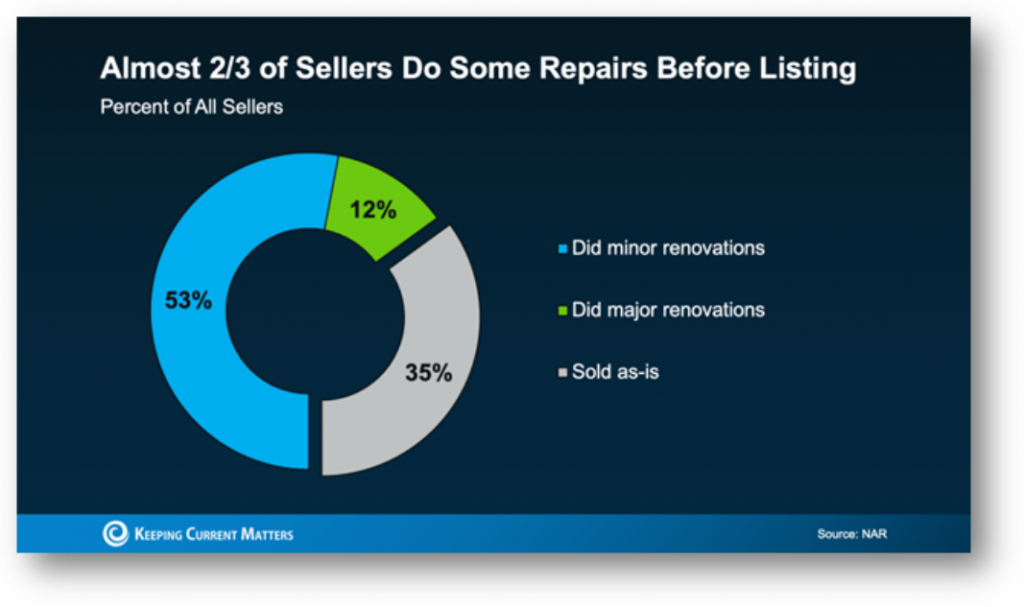

Un estudio reciente de la Asociación Nacional de Agentes Inmobiliarios (NAR) reveló que el 65% de los vendedores realizaron pequeñas reparaciones o mejoras antes de vender, mientras que solo el 35% vendió sus casas en el estado en que se encontraban (véase el gráfico).

Qué Significa Realmente Vender Una Propiedad «Tal Cual»

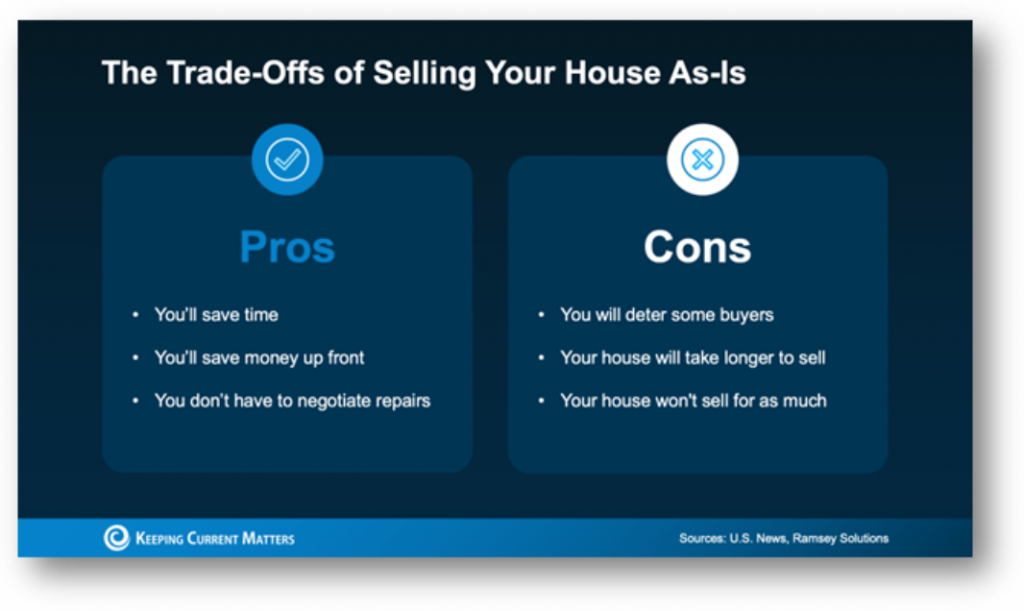

Vender una propiedad «tal cual» significa informar a los compradores desde el principio que no se realizarán reparaciones antes de la venta ni se negociarán arreglos después de la inspección. Si bien esto puede simplificar el proceso para el vendedor, a menudo limita el número de compradores potenciales.

Las casas listas para habitar suelen atraer más interés y recibir ofertas más atractivas. Las propiedades que necesitan reformas suelen tener menos visitas, menos ofertas y pueden permanecer más tiempo en el mercado, lo que a menudo resulta en un precio final más bajo.

Esto no significa que una casa que se vende «tal cual» no se venda. Simplemente significa que es posible que no se venda al precio máximo que podría alcanzar.

Cómo El Asesoramiento Marca La Diferencia

No existe una respuesta única para todos. La mejor opción depende de su vivienda, su presupuesto y el mercado local.

Ahí es donde el asesoramiento de un experto resulta fundamental. Un profesional con experiencia puede ayudarle a comprender qué reparaciones (si las hay) vale la pena realizar y cuál podría ser el precio de venta de su casa en cualquier caso.

- Si vende la propiedad tal como está: la atención se centra en destacar la ubicación, la distribución y el potencial a largo plazo.

- Si realiza reformas: puede priorizar las mejoras que más importan a los compradores, sin gastar de más.

¿La buena noticia? Dado que la primavera suele ser la temporada alta para la compra de viviendas, todavía hay tiempo para tomar decisiones bien pensadas sin prisas.

En Resumen

Vender una propiedad tal como está puede ser una buena opción en ciertas situaciones, pero en el mercado actual, podría tener un costo. No es necesario realizar reparaciones antes de poner la casa en venta, pero vale la pena analizar todas las opciones antes de tomar una decisión.

Como parte de su Programa de Adquisición de Vivienda para Empleados de Advantage Home Plus, no tiene que tomar esta decisión solo. Los empleados que estén pensando en vender su casa pueden acceder a asesoramiento para:

- Comprender cómo la venta tal como está, en comparación con la realización de mejoras, puede afectar el precio y el plazo de venta.

- Analizar las prioridades de reparación y si es probable que las mejoras resulten rentables.

- Planificar su próximo paso, incluyendo la compra de otra vivienda o la coordinación de los plazos de venta.

- Obtener claridad antes de poner la casa en venta, para evitar sorpresas.

- Una breve conversación puede ayudarle a evaluar las ventajas y desventajas y decidir qué es lo más conveniente para su situación, antes de poner su casa en el mercado.

Una breve conversación puede ayudarle a evaluar las ventajas y desventajas y decidir qué es lo más conveniente para su situación, antes de poner su casa en el mercado.

SupportSquad@AdvantageHomePlus.com | (800) 511-2197

La información y las opiniones expresadas en este artículo no deben interpretarse como asesoramiento de inversión. Advantage Home Plus no garantiza la exactitud ni la integridad de la información ni de las opiniones aquí contenidas. Nada de lo aquí expuesto debe considerarse asesoramiento de inversión. Siempre debe realizar su propia investigación y análisis, y obtener asesoramiento profesional antes de tomar cualquier decisión de inversión. * Las contribuciones a las comisiones inmobiliarias están disponibles según lo permitan las leyes estatales.